The 1st Action In assisting you with your Claim is to Review and understand your Policy, and the 2nd is to review if your policy is written either as a Replacement Cost and or an Actual Cash Value: Replacement cost policies provides you with the dollar amount needed to replace a damaged item with one of a similar kind and quality without deducting for depreciation (the decrease in value due to age, wear and tear, and other factors). Actual cash value policies pay the amount needed to replace the item minus depreciation.

Suppose, for example, a tree fell through the roof onto your eight-year-old washing machine. With a replacement cost policy, the insurance company would pay to replace the old machine with a new one. If you had an actual cash value policy, the company would pay only a part of the cost of a new washing machine because a machine that has been used for eight years is worth less than its original cost.

Extended and Guaranteed Replacement Cost: If your home is damaged beyond repair, a typical homeowner’s policy will pay to replace it up to the limits of the policy. If the value of your insurance policy has kept up with increases in local building costs, a similar dwelling can generally be built for an amount within the policy limits.

With an extended replacement cost policy your insurance company will pay a certain percentage over the limit to rebuild your home — 20 percent or more, depending on the insurance company; so that if building costs go up unexpectedly, you will have extra funds to cover the bill. A few insurance companies offer a guaranteed replacement cost policy that pays whatever it costs to rebuild your home as it was before the disaster. But neither type of policy will pay for more expensive materials than those that were used in the structure that was destroyed.

Your Local Agent will be able to assist in providing you with the proper coverage and or extra coverage you may need. Please review all our preferred agents.

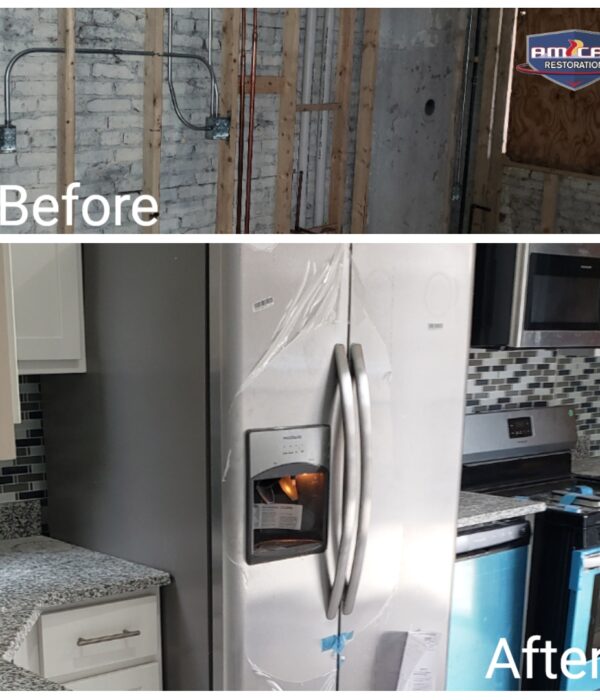

![PhotoGrid_Plus_1614263047452[1] PhotoGrid_Plus_1614263047452[1]](https://am-cat.com/wp-content/uploads/2017/03/PhotoGrid_Plus_16142630474521-600x700.jpg)